Hawaii paycheck tax calculator

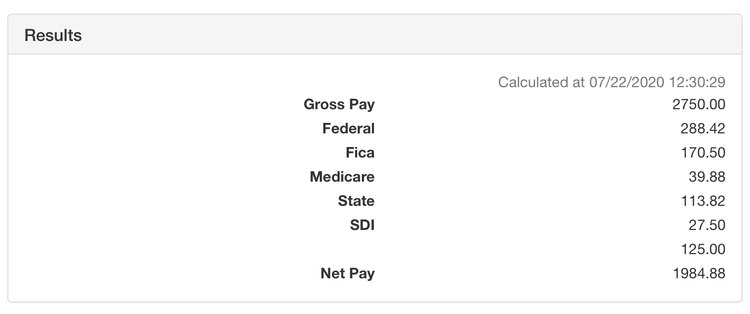

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay. On the other hand if you make more than 200000 annually you will pay.

Free Hawaii Payroll Calculator 2022 Hi Tax Rates Onpay

Your employees estimated paycheck will be 70372.

. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Hawaii. Below are your Hawaii salary paycheck results. The results are broken up into three sections.

You can use our free Hawaii income tax calculator to get a good. Hawaii Paycheck Calculator Use ADPs Hawaii Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Kentucky is one of the states that underwent a tax revolution in 2018 making its tax rates much easier to follow and learnSince 2018 the state has charged taxpayers with a flat income tax.

Below are your Hawaii salary paycheck results. 2022 tax rates for federal state and local. The Hawaii Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Hawaii State.

Lets go through your gross salary in further depth. Employees reconcile their withholding taxes paid as part of their Individual. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The regular hours of work during this pay period will also be 50. Hawaii Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Free Unbiased Reviews Top Picks.

The 2022 tax rates range from 02 to 58 on the first 500 in wages paid to each employee in a calendar year. Your average tax rate is 1810 and your marginal tax rate is. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Hawaii. Your average tax rate is 239 and your marginal tax rate is 381. The results are broken up into three sections.

Simply enter their federal and state W-4 information as. Search jobs Search salary. This marginal tax rate means that your.

Ad Get the Paycheck Tools your competitors are already using - Start Now. Calculate your federal Hawaii income taxes Updated for 2022 tax year on Aug 31 2022. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Hawaii Hourly Paycheck Calculator Results. Ad Compare This Years Top 5 Free Payroll Software. All Services Backed by Tax Guarantee.

That means that your net pay will be 41883 per year or 3490 per month. Hawaii Income Tax Calculator 2021 If you make 152500 a year living in the region of Hawaii USA you will be taxed 41033. Well do the math for youall you need to do is enter.

Paycheck Results is your gross pay and. Employers then pay the withheld taxes to the State of Hawaii Department of Taxation DOTAX. Hawaii Salary Paycheck Calculator Change state Calculate your Hawaii net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

Just enter the wages tax withholdings and. If youre a new employer congratulations you pay a flat. Your average tax rate is 1198 and your marginal tax rate is.

The Hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2022. The state income tax rate in Hawaii is progressive and ranges from 14 to 11 while federal income tax rates range from 10 to 37 depending on your income. Hawaii Income Tax Calculator 2021 If you make 70000 a year living in the region of Hawaii USA you will be taxed 14386.

Hawaii Paycheck Calculator Smartasset

A Small Business Guide To Doing Manual Payroll

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Excel Formula Income Tax Bracket Calculation Exceljet

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Reverse Sales Tax Calculator

Calculating Payroll For Employees Everything Employers Need To Know

Hawaii Paycheck Calculator Adp

How Unemployment Benefits Are Calculated By State Bench Accounting

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Hawaii Paycheck Calculator Adp

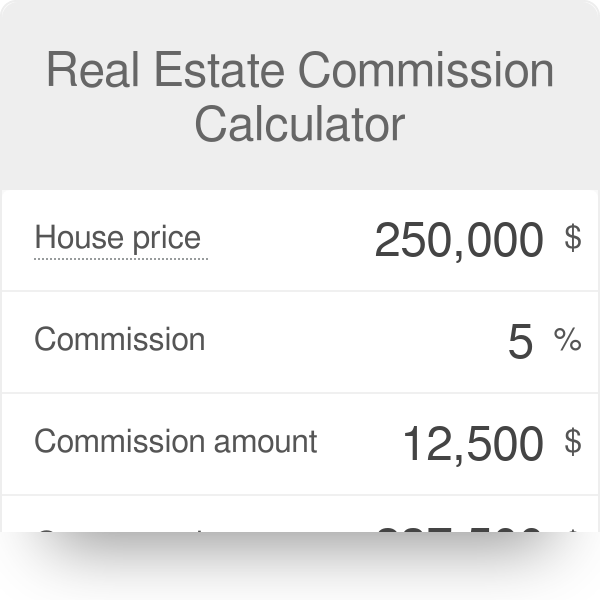

Real Estate Commission Calculator

2022 Capital Gains Tax Rates By State Smartasset

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

4 Steps To Be More Financially Conscious This Year Hawaii Home Remodeling Debt Collection Managing Your Money Consumer Debt